Key findings

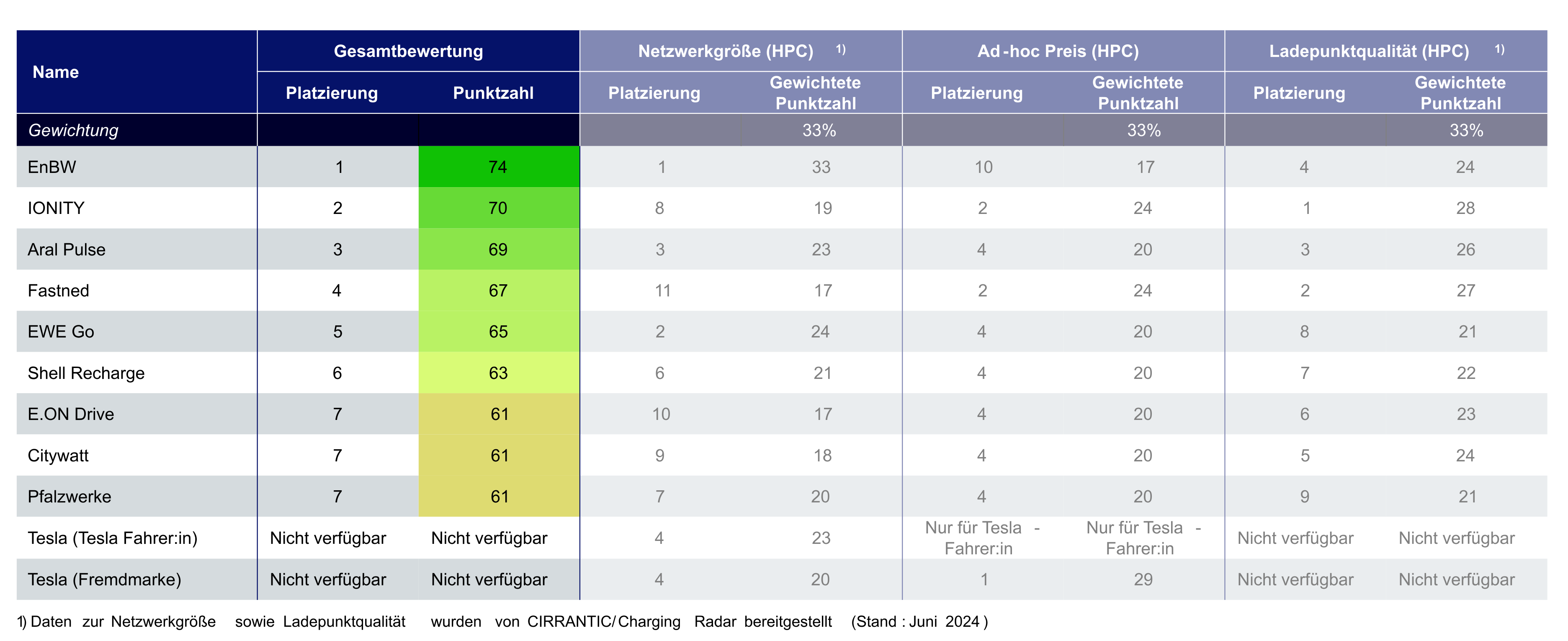

Network Size EnBW emerged as the leader in network size, operating over 4.400 HPC points across more than 1.000 locations. Their strategy of developing large HPC hubs at key traffic points has paid off, providing extensive coverage. EWE Go and Tesla follow, with EWE Go focusing on numerous sites with fewer points per location, and Tesla emphasising larger sites with more points per location.

Ad-Hoc Pricing Tesla offers the most competitive ad-hoc pricing for non-Tesla drivers, at €0,54 per kWh. However, Tesla’s pricing varies by location and time, reflecting real-time market conditions. Fastned and IONITY also provide competitive rates at €0,69 per kWh, while EnBW, despite its expansive network, has the highest ad-hoc price of €0,87 per kWh, including a time-based fee.

Charging Point Quality IONITY leads in charging point quality, thanks to their high uptime and substantial maximum power output per connector. Fastned and EnBW also score high, showing robust performance across various technical parameters. The criteria for quality assessment include uptime, the incidence of problematic charging sessions, occupancy rates, and the availability of features like Plug & Charge or AutoCharge.

Market Dynamics

Germany’s public charging infrastructure has grown significantly. By early 2024, there were about 20.000 HPC points, with the top 10 CPOs covering over 13.700 of these. This expansion is essential as the number of battery-electric vehicles (BEVs) rose to over 1,4 million by the start of 2024. However, the end of EV subsidies in December 2023 led to fewer new registrations.

Charging infrastructure growth has outpaced the increase in BEVs, with a 40% rise in HPC points. This trend towards higher charging capacities and shorter charging times supports long-distance travel and user convenience.

Strategic Insights

CPOs are not just expanding their networks but also improving user experience. More amenities at charging sites, like restrooms and shops, are becoming common, especially at Aral Pulse locations. Competitive pricing through proprietary apps encourages users to stick with a particular network.

Reliable and high-quality charging infrastructure is crucial for boosting user confidence and EV adoption. The focus will likely shift from just expanding networks to improving cost efficiency and charging quality. Many operators have already reached a critical mass in network size.

Future Outlook

The future of Germany’s charging infrastructure looks promising. Continued growth is expected in both the number of charging points and their quality. Initiatives like the “Deutschlandnetz” and regulations for charging stations at petrol stations will further boost this growth.

The eMobility Excellence CPO-Benchmark Report 2024 offers valuable insights into the current state and future of Germany’s HPC market. As the market evolves, balancing network expansion with pricing and quality improvements will be key. This report is a crucial tool for understanding these dynamics and guiding future developments in the sector.