Break-down country-specific EV Sales Outlook for 2025

Stability in public policy will be crucial for sustaining growth. Moreover, Europe faces increasing competition from Chinese automakers, who are introducing more affordable models. In response, the EU is considering additional tariffs on Chinese imports, which could impact market dynamics.

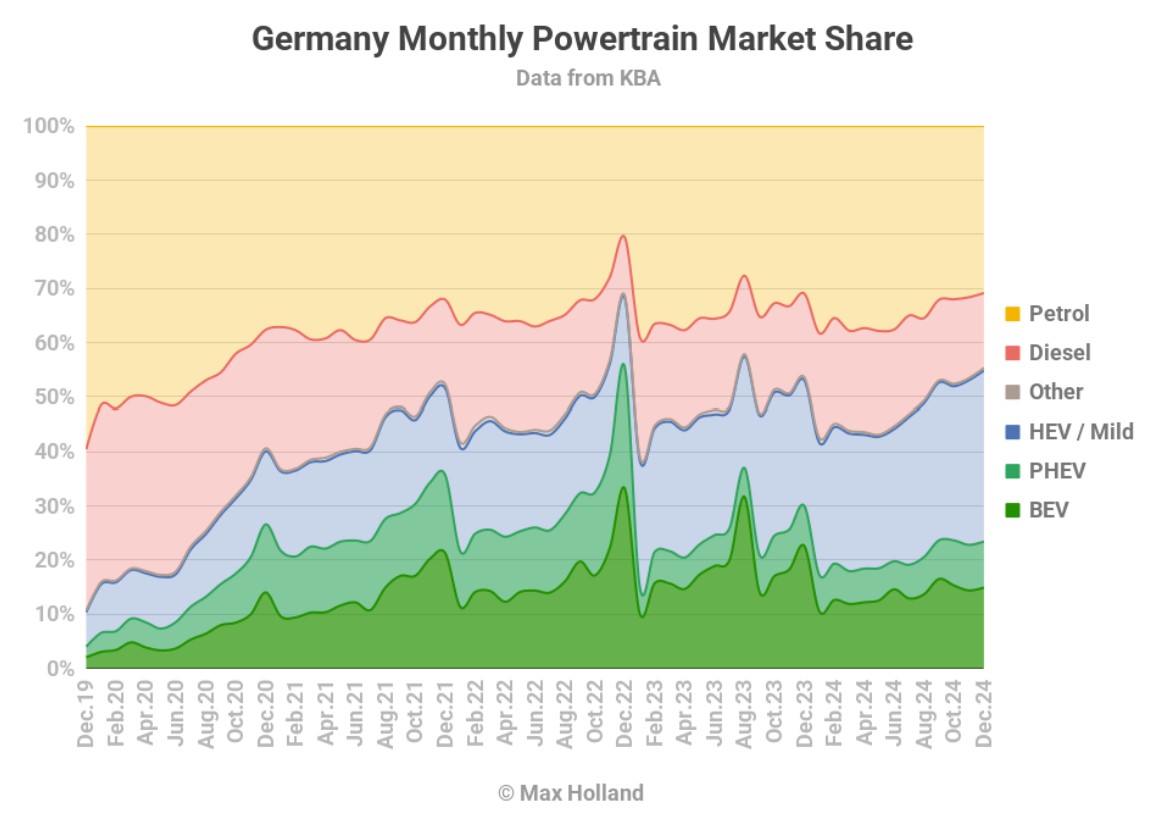

Outlook German EV Market 2025: revival of Europe’s giant with an expected record-breaking 873.000 EV Sales for electric cars

According to data from the German Association of the Automotive Industry (VDA), Germany, Europe’s largest automotive market, plays a key role in electrifying the European vehicle fleet. The strict CO₂ fleet regulation requires a significant increase in new registrations of electric vehicles.

In 2025, approximately 873.000 electric cars are expected to be newly registered, marking a 53% increase compared to 2024.

The growth will be driven mainly by battery-electric vehicles (BEVs), which are projected to increase by 75% to 666.000 units.

Plug-in hybrids (PHEVs) are expected to rise by 8% to 207,000 units.

Germany remains a cornerstone of Europe’s EV transition, with a strong focus on meeting emissions targets and maintaining its competitive edge in the global auto industry.

Outlook United Kingdom’s EV Market 2025: Strong growth amid policy adjustments

According to the Society of Motor Manufacturers and Traders (SMMT), the UK is expected to remain one of Europe’s largest EV markets in 2025, driven by government mandates and incentives:

In 2025, new EV registrations are projected to reach 660.000, reflecting continued demand growth.

BEV registrations are expected to reach 462.000 units, while PHEV sales will contribute 198.000 units.

BEV market share is expected to surpass 25%, aided by government-enforced EV sales quotas for automakers.

Consumer incentives and charging infrastructure investments are crucial in maintaining momentum, especially as subsidy reductions impact private buyers.

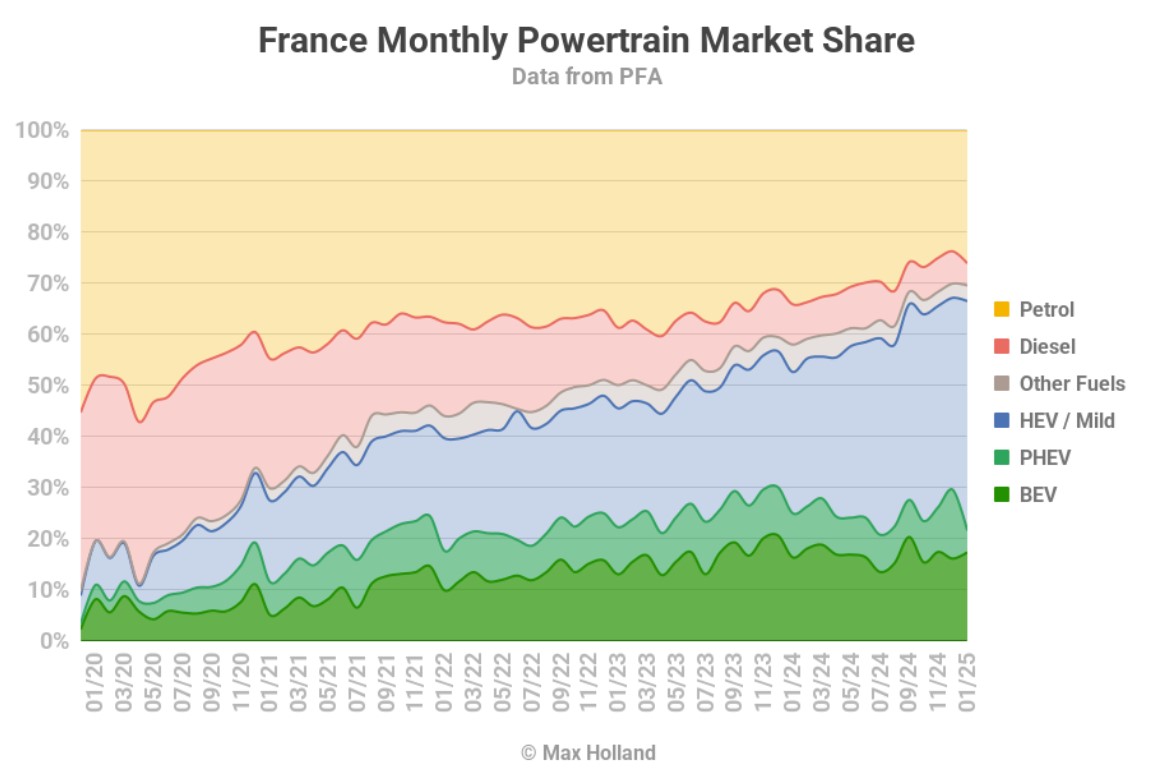

Outlook French EV Market 2025: Policy-Driven Expansion with Market Adjustments

Data from France’s Ministry for Ecological Transition suggests that EV adoption will continue at a steady pace, although recent subsidy cuts may slow overall growth:

France is projected to see steady EV adoption, although recent subsidy cuts may slow overall growth:

EV sales in 2025 are expected to exceed 550.000, with BEVs comprising a significant portion – increasing from 17% to 22% of the overall national car sales.

The government has adjusted its incentive programs, focusing on income-based EV leasing schemes to support lower-income buyers.

French manufacturers, including Renault and Peugeot, are ramping up production of affordable electric models to remain competitive.

Factors Fueling Rapid Growth

Regulatory Mandates: The European Union has implemented stringent CO₂ emission targets, compelling automakers to increase their EV offerings. From 2025, these regulations require car manufacturers to ensure that over 20% of their sales are zero-emission vehicles. This regulatory push is a primary catalyst for the expected surge in EV sales.

Diverse Model Availability: In 2025, consumers will access more than 160 EV models, including affordable options priced below €25,000, such as the Renault 5 and Citroën ë-C3. This expanded selection aims to cater to a broader audience, making EVs more accessible to the average consumer.

Technological Advancements: Continuous improvements in battery technology have led to longer ranges and reduced charging times, addressing two of consumers’ main concerns regarding EVs. These advancements enhance the practicality and appeal of electric vehicles.

Challenges ahead: Will there be a loss of 16 billion for car makers in 2025?

Despite the optimistic outlook, the EV market faces several hurdles:

Profit Margins Under Pressure: The high costs associated with meeting stringent emissions standards, coupled with the need to offer competitive pricing, may erode profit margins for automakers. The European car industry body, ACEA, estimates that fines, carbon credit costs, and selling EVs at a loss could cost carmakers €16 billion if 2025 fines are not delayed.

Consumer Hesitation: While regulatory pressures drive supply, consumer demand remains volatile. However, this is expected to be resolved within a few years due to decreasing prices and vehicles reaching price parity with internal combustion engine (ICE) vehicles.

Global Competition and Trade Policies: The influx of competitively priced Chinese EVs into the European market has raised concerns about market saturation and the potential impact on local manufacturers. In response, the European Union has imposed additional tariffs on Chinese-made EVs to protect its domestic industry.

Sources

Matthias Schmidt Automotive Research

Society of Motor Manufacturers and Traders (SMMT)

France’s Ministry for Ecological Transition

German Association of the Automotive Industry (VDA)

European Automobile Manufacturers’ Association (ACEA)

CleanTechnica, Max Holland