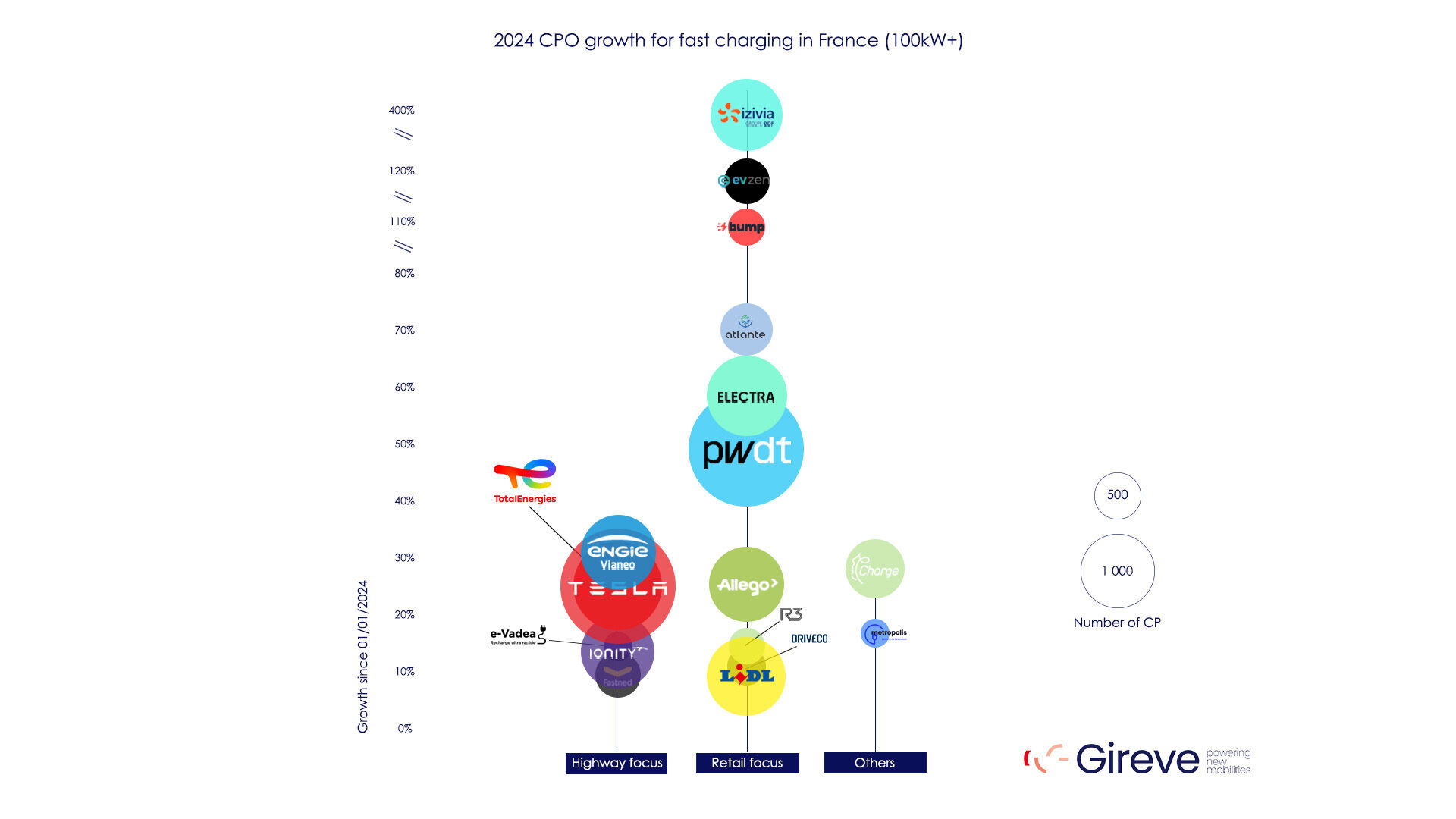

The article shows that the most substantial growth is happening in retail locations. Operators like Powerdot, Electra, and IZIVIA have moved quickly to install fast chargers in places where people are already spending time, such as supermarkets and shopping centers. This shift reflects a growing recognition that charging needs to fit seamlessly into daily life, rather than being limited to highways or long-distance travel hubs.

Retail-focused CPOs outpace the rest

The key players driving growth in 2024 are the CPOs that focus on retail locations. Powerdot, in particular, has surged ahead of the competition, installing more fast-charging points than any other operator in France. This rapid expansion is fuelled by a strategy that prioritises convenience for drivers, placing chargers where people are likely to leave their vehicles for extended periods.

Powerdot’s network now includes over 1.000 charge points, with more being added every month. Their model focuses on “destination charging,” where EV drivers can top up their batteries while they shop, run errands, or attend appointments. This makes the process of charging less about planning a trip around the availability of a charger and more about incorporating it into daily routines.

Electra and IZIVIA have adopted similar approaches, partnering with major retail brands to roll out charging stations across France. Electra, for instance, has formed strategic partnerships with companies like AccorInvest and Groupe Casino, which gives them access to prime real estate for their charging stations. IZIVIA has also seen impressive growth through its partnerships with retailers like McDonald’s, rapidly expanding its IZIVIA Express and IZIVIA Fast networks.

Slower growth on highways

While retail-focused CPOs are growing rapidly, operators with a focus on highway charging infrastructure, like TotalEnergies, ENGIE, and Tesla, have seen more modest growth in 2024. These companies still play a crucial role in supporting long-distance EV travel, but their expansion has been slower compared to their retail-focused counterparts.

Building and maintaining fast chargers on highways requires significant investment and long-term planning, which can make growth more gradual. Additionally, highway charging in France is already relatively well-developed, meaning there is less pressure to build new stations as quickly as in urban or retail areas.

That said, highway charging remains a vital part of the broader EV infrastructure, particularly for drivers traveling long distances. Tesla, for example, continues to operate one of the most reliable and extensive networks of highway charging stations, offering fast and consistent charging for Tesla owners. However, as more drivers switch to EVs for daily commuting and shorter trips, the focus on retail charging is expected to grow.

New players and partnerships fuel expansion

The fast-charging landscape in France is becoming more competitive, with new players entering the market and existing operators forming key partnerships to drive growth. For example, e-Vadea, a relatively new entrant, has quickly gained ground by partnering with large retail and real estate companies to expand its network.

These partnerships are crucial for scaling up fast-charging infrastructure. IZIVIA’s work with McDonald’s, Electra’s collaboration with Groupe Casino, and Bump’s alliances with brands like Lapeyre and Intermarché are just a few examples of how retail players are helping CPOs expand their networks. By installing chargers in places where people are already spending time, these partnerships make it easier for drivers to charge their vehicles as part of their daily routine.

The competition among CPOs is intensifying, and it’s clear that those who can secure strategic partnerships and roll out chargers quickly will have an advantage.

Growth in numbers

The data from Gireve offers a clear picture of the growth happening in 2024. Powerdot leads the way with the highest number of fast-charging points, outpacing other CPOs by a significant margin. This growth is particularly impressive given the already large size of its network, and it’s a testament to Powerdot’s ability to scale efficiently.

Electra and IZIVIA also continue to grow rapidly, thanks in large part to their retail-focused strategies. These operators have shown that there’s a huge demand for charging stations in everyday locations, and they’ve been quick to meet that demand with well-placed installations.

At the same time, more established highway-focused CPOs like TotalEnergies and Tesla continue to serve long-distance travelers, though their pace of growth has slowed as they focus on maintaining their existing infrastructure.

The road ahead for fast charging

The fast-charging landscape in France is changing rapidly, with retail locations emerging as the new front line in the battle to build charging infrastructure. Powerdot, Electra, and IZIVIA are leading the charge, proving that the future of fast charging lies in making it as convenient as possible for everyday drivers.

While highway charging will always be important for long-distance travel, the trend toward retail-based charging solutions is likely to continue as more people adopt EVs for daily use. The convenience of being able to charge while shopping, dining, or working is becoming a major selling point for consumers, and CPOs are responding by building more stations in these high-traffic areas.

However, there are still challenges to overcome. Recent reports from EV drivers in France point to the need for improvements in charging station reliability, particularly for long-distance travel. Ensuring that fast chargers are not only widely available but also dependable will be crucial for maintaining consumer confidence and encouraging further adoption of electric vehicles.

As 2024 progresses, it’s clear that the growth of fast-charging infrastructure will play a key role in shaping the future of electric mobility in France. With retail-focused CPOs leading the way, the expansion of EV charging networks is on a fast track to becoming more accessible and consumer-friendly.