A steep rise in Chinese BEV imports

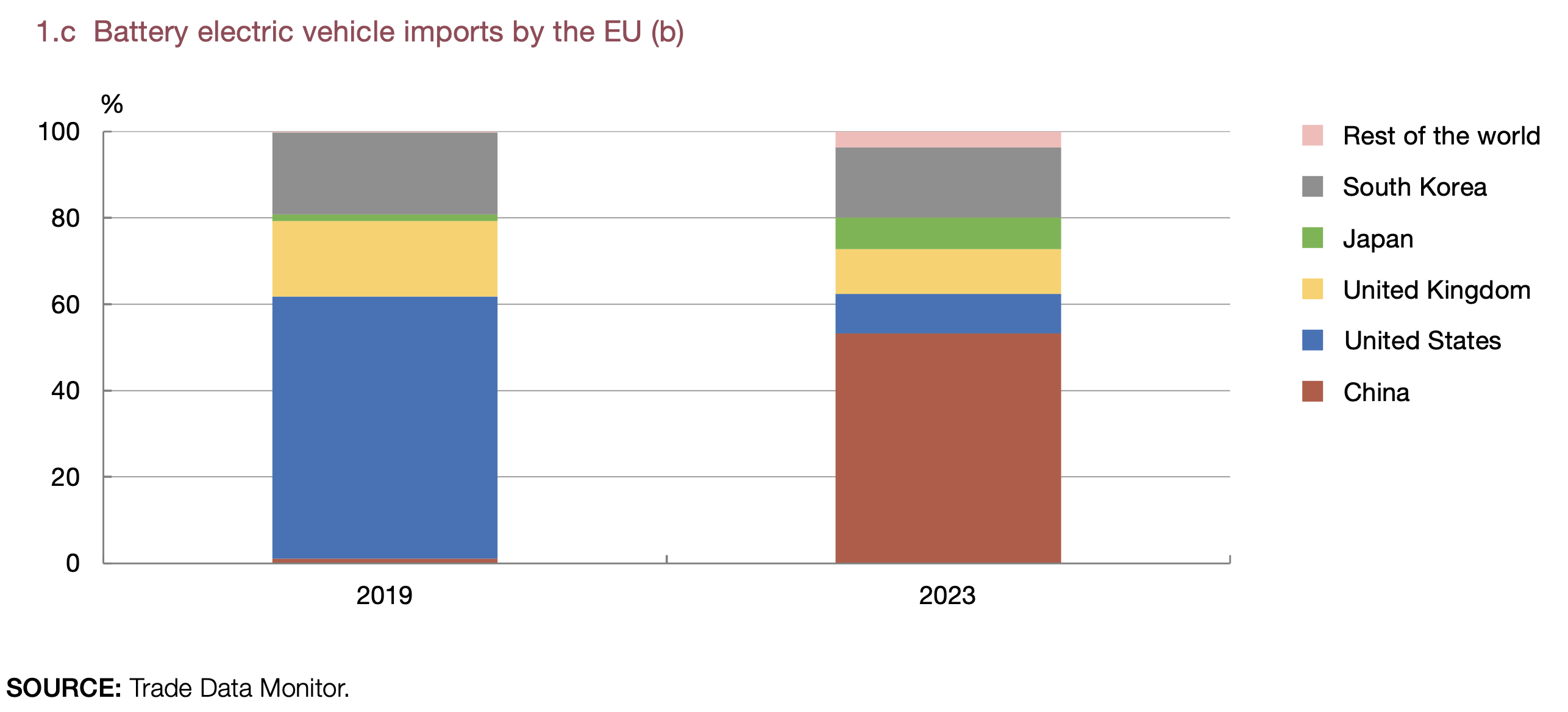

In recent years, the European market has seen a dramatic rise in BEV sales. By 2023, these vehicles made up 15% of all new car sales across the EU, a substantial increase from just 1,9% in 2019. Chinese manufacturers, known for their lower production costs and tech-savvy designs, have been quick to seize this opportunity. The share of Chinese-made BEVs entering Europe jumped from 1% in 2019 to over 50% in 2023. These imports include both established Chinese brands like BYD and foreign brands such as Tesla, which manufacture their vehicles in China for export.

This trend is reshaping the electric vehicle market in Europe. In countries like Spain, more than half of all imported BEVs came from China in 2023. While the percentage is lower in Germany and France, around 16%, the impact is still significant. This influx of more affordable models has broadened access to electric vehicles, making it easier for European consumers to make the switch from traditional gas-powered cars.

Why is China dominating the market?

China’s rise as a major BEV exporter is due to several key factors:

Strong government support: The Chinese government has backed the electric vehicle industry for decades. Starting as early as its 10th Five-Year Plan (2001-2005), China identified “new energy vehicles” as a key focus. Since then, a series of initiatives, like the “Made in China 2025” plan, have helped drive the sector’s growth. Government subsidies, research investment, and infrastructure support have made it easier for Chinese manufacturers to scale up quickly.

Control of the supply chain: China has a strong hold over the production of essential battery components like lithium, cobalt, and graphite. This control extends from mining raw materials to refining them and manufacturing batteries. As a result, Chinese battery production costs are about 17% lower than those in Europe, making Chinese-made BEVs more competitive. Batteries, after all, can account for up to 40% of a BEV’s total cost.

Economies of scale: China’s large domestic market for electric vehicles has allowed manufacturers to achieve economies of scale, driving down production costs. With such a large customer base at home, Chinese manufacturers have been able to optimize their production processes and bring down prices—making their cars even more appealing to cost-conscious European buyers.

Challenges for Europe’s auto industry

While the influx of Chinese-made BEVs supports Europe’s transition to cleaner transportation, it also raises significant concerns among policymakers and European carmakers. The auto industry plays a crucial role in the European economy, contributing roughly 10% of the region’s manufacturing output and providing millions of jobs. The sharp rise in Chinese imports has sparked fears that European manufacturers could lose market share, echoing the challenges faced by the European solar panel industry a decade ago when it struggled against Chinese competition.

In response, the European Commission launched an anti-subsidy investigation into Chinese BEV imports in October 2023. The investigation found that state subsidies were giving Chinese manufacturers an unfair edge, leading to the introduction of tariffs in October 2024. These tariffs, ranging up to 36,3%, aim to balance the playing field by offsetting the impact of Chinese government support.

However, these measures come with potential downsides. Tariffs could raise the prices of BEVs in Europe, possibly slowing the adoption of electric vehicles at a time when the region is pushing hard to cut carbon emissions. Additionally, there is a risk that these trade barriers could trigger retaliatory moves from China, escalating tensions between the two economic giants.

Strategic shifts in response

As the trade landscape evolves, manufacturers on both sides are adjusting their strategies. Some Chinese companies have started exploring opportunities to establish production facilities in Europe. For instance, BYD, one of China’s leading electric vehicle makers, has announced plans to set up a plant in Hungary. This move could help Chinese brands avoid European tariffs while creating local jobs and expanding their footprint in Europe.

These investments could partially ease competitive pressures on European manufacturers, but they also signal that competition is here to stay. Even with local production, European automakers will still face challenges from Chinese brands producing vehicles directly in the region, which could affect their market share and pricing strategies.

A balanced opportunity

Despite the challenges, the surge in Chinese BEV imports offers some positive outcomes for Europe. The availability of lower-cost electric vehicles can help speed up the shift toward green transportation, bringing electric cars within reach for a broader range of European consumers. This aligns well with the EU’s climate goals, including the ambitious target of becoming carbon-neutral by 2050.

Moreover, the increased competition could be a catalyst for innovation within the European auto industry. With Chinese brands pushing down prices, European manufacturers may be compelled to find new ways to reduce production costs and introduce more advanced, appealing models to stay competitive. In the long run, this could result in a more dynamic and consumer-friendly electric vehicle market.

Looking ahead

The rapid growth of Chinese BEV imports has reshaped Europe’s automotive market, presenting both opportunities for progress and challenges to established players. As Europe seeks to balance the benefits of affordable, Chinese-made electric vehicles with the need to protect its own industry, the future of the market will depend on careful policy choices and the ability of European manufacturers to adapt.

The recent tariffs imposed by the European Commission are an attempt to strike that balance, but they also risk slowing the growth of electric mobility just when it is gaining momentum. Meanwhile, new investments by Chinese firms in European manufacturing could bring some economic benefits, even as they increase competition. As trade dynamics continue to shift, Europe’s electric vehicle market faces a critical juncture—one that could shape the future of transportation on the continent for years to come.

Source: Banco de España