Despite home charging points making up about 87% of this total, nearly 57% of all EV charging energy will come from public and workplace stations. This report dives into the structure of the EV charging software market, identifying key opportunities for growth, differentiation, and success.

Three key areas of the EV charging software market

The report categorises the EV charging software market into three main segments based on function, each serving different needs across the EV ecosystem:

- Charge Point Management Software (CPMS): At the core, CPMS provides essential support for managing charging points, particularly for charge point operators (CPOs). It includes software for monitoring, troubleshooting, billing, and integrating third-party tools. This backend software is vital for ensuring that public and high-use stations run smoothly and reliably.

- eMobility Service Provider (eMSP) solutions: Known as “white-label” solutions, these offerings are often front-facing and allow EV drivers to locate, access, and pay for charging services through apps. They simplify the user experience, providing a bridge between drivers and charge point operators.

- Add-on services: This final segment enhances both CPMS and eMSP solutions. It includes features like customer hotlines, smart charging options, and dynamic pricing. These add-ons boost customer satisfaction and operational efficiency by tailoring services to meet specific demands.

This structure allows providers to address a range of customer needs, from individual drivers to fleet operators, and highlights a major theme in the report: adaptability. Public charging stations, for instance, emphasise transaction management and roaming for a more transient user base, while workplace and home chargers focus on load management and fleet integration.

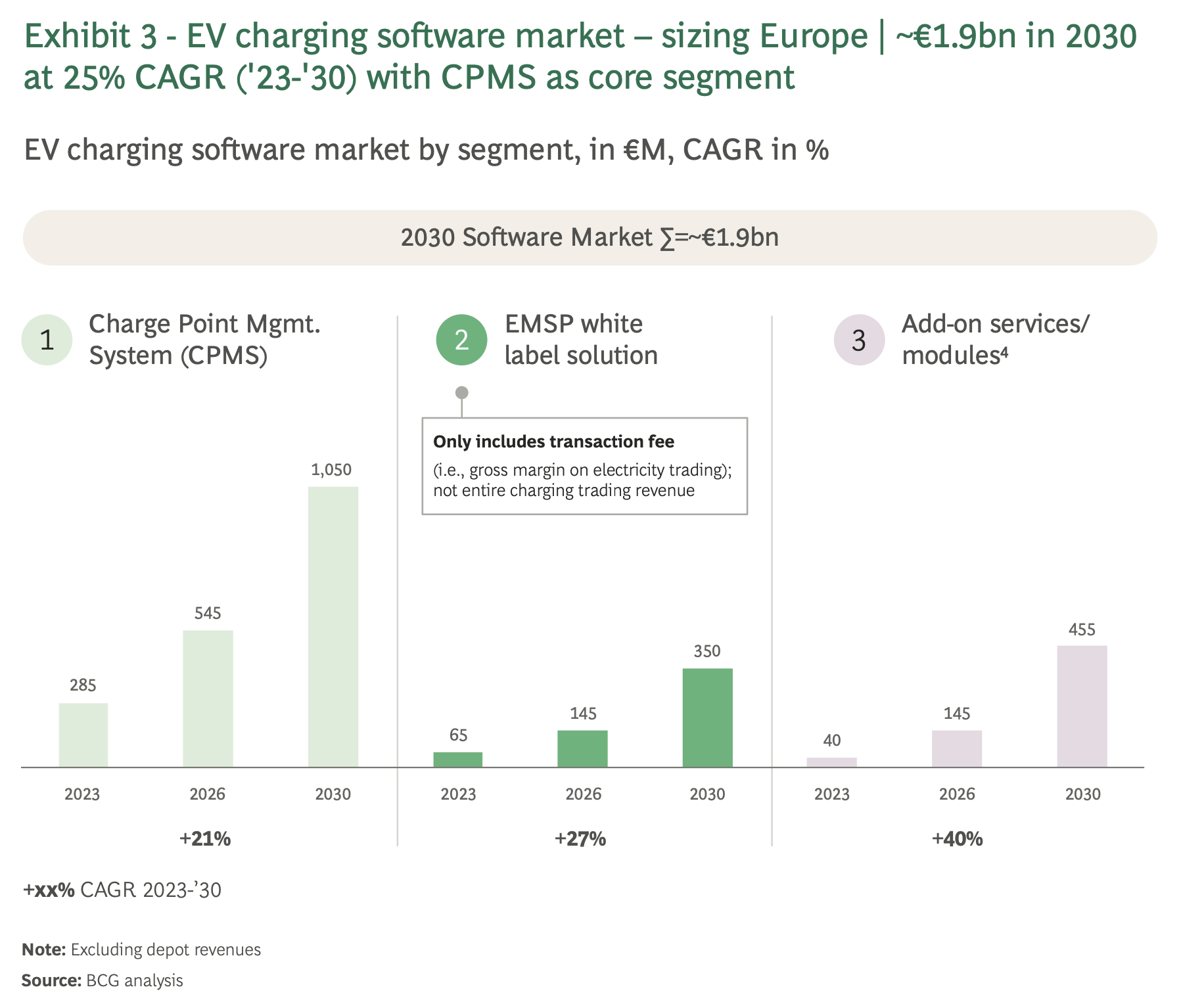

Market growth: €390 million today, €1.9 billion by 2030

The European EV charging software market is on an ambitious growth path, with BCG projecting a leap from €390 million in 2023 to nearly €1.9 billion by 2030. CPMS is expected to lead the way, growing from €300 million to over €1 billion by the end of the decade, driven by demand from high-use, public, and workplace chargers. Add-on services, though currently the smallest segment, are anticipated to see the fastest growth rate—around 40% per year—reaching nearly €500 million by 2030 as providers find ways to upsell to existing customers. Meanwhile, eMSP solutions, crucial for direct driver interactions, are projected to grow by 27% annually to about €350 million by 2030.

Fragmented landscape: Over 50 players and intense competition

In Europe, the CPMS market is highly fragmented, with more than 50 companies vying for space. Players range from hardware providers with basic backend solutions to specialists focusing exclusively on public charging software. In this varied landscape, BCG’s analysis shows that companies with strong regional or niche focuses tend to perform well, carving out competitive advantages by tailoring their offerings to specific customer needs. Providers with a stronghold in central Europe, for example, have successfully targeted mid-sized operators with dedicated software solutions and built customer loyalty through customized support.

Success factors: Focus, adaptation, and smart growth strategies

To succeed in this competitive market, BCG offers five guiding strategies for EV charging software providers:

- Expand with precision: For CPMS providers, regional growth has proven essential. But as the market evolves, expanding into key European regions—especially Germany, France, and the UK—will be necessary. These top markets are expected to account for more than half of all public charging points in Europe by 2030. Gaining a foothold in these areas could help CPMS providers compete with larger, established players.

- Prioritise customer-centric solutions: Each type of customer, from hotel operators to retailers, has unique requirements. Providers can differentiate themselves by developing custom solutions tailored to each industry. While some large CPOs have moved to in-house software to streamline international expansion, BCG expects them to re-outsource as third-party software evolves, creating new opportunities for CPMS providers.

- Accelerate market entry through acquisitions: Strategic acquisitions can help CPMS providers grow their presence and capabilities quickly. ChargePoint’s acquisition of has.to.be GmbH, for example, expanded its European reach while adding full “Charging as a Service” (CaaS) offerings. With the European Alternative Fuels Infrastructure Regulation encouraging more interoperability, mergers can allow companies to operate more seamlessly across regions.

- Invest in innovation and integration: The EV industry is evolving fast, and CPMS providers need to keep pace with developments like AI-driven predictive maintenance and Vehicle-to-Grid (V2G) integration. R&D investments will be crucial for staying competitive. Integrating CPMS with eMSP solutions can also enhance customer experiences, allowing companies to offer additional value through advanced features like real-time pricing adjustments or charging session optimisation.

- Redefine revenue models: As utilisation rates climb, CPMS providers could benefit from testing new pricing models. Options such as energy reselling for smaller CPOs and “creative” pricing adjustments (e.g., higher transaction fees in exchange for lower base fees) could help CPMS providers strengthen revenue streams in a crowded market. Providers must adapt their models based on their customer base’s needs and preferences to stay profitable.

Final thoughts: Thriving amid change in EV charging software

BCG’s report paints a picture of a fast-evolving, highly competitive market where software providers need agility and focus to succeed. As the number of EVs on the road continues to climb, so does the need for reliable, customer-focused charging solutions. For companies in this space, the time is now to develop scalable, versatile software that meets the needs of an increasingly electric future. By adapting to regional demands, embracing innovation, and building partnerships, companies have a real shot at thriving in this critical sector.

Source: BCG