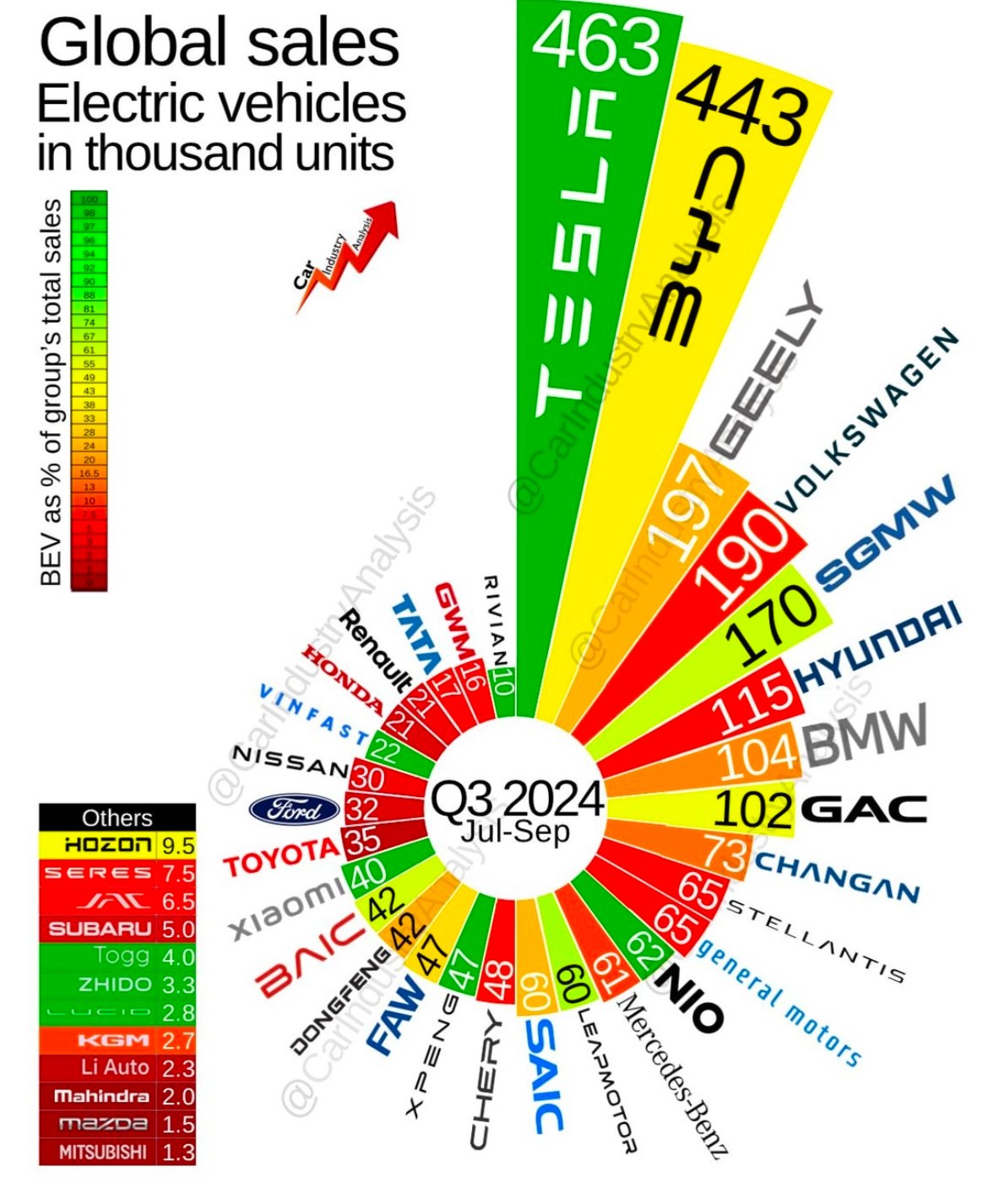

Tesla holds the top spot, BYD close behind

Tesla maintained its position as the world’s leading EV manufacturer, delivering 463.000 vehicles in the third quarter. BYD followed closely with 443.000 units, narrowing the gap between the two giants to just 20.000 vehicles. This near tie underscores the fierce competition at the top, with many industry observers speculating that BYD could surpass Tesla as early as next year.

Tesla’s success continues to revolve around its best-selling models, the Model Y and Model 3, which have cemented their appeal across global markets. Meanwhile, BYD’s strategy of offering a diverse lineup at competitive prices has proven effective, particularly in China, where it dominates the market. BYD is also making strides internationally, gaining traction in Europe and other regions.

Geely and Volkswagen compete for third place

In the tier below Tesla and BYD, Geely edged out Volkswagen to claim the third spot. Geely sold 197.000 EVs, narrowly beating Volkswagen’s 190.000. This marks a significant achievement for the Chinese automaker, which has benefited from strong demand for its ZEEKR models and the launch of its Galaxy sub-brand. Both have struck a chord with consumers, offering a mix of innovation and style.

Volkswagen, a long-standing global automotive powerhouse, continues to adapt to the EV transition. Its ID. series has performed well, particularly in Europe, but increasing competition has made it harder for the company to maintain its footing in this fast-changing market.

SGMW, Hyundai-Kia, and BMW follow

The SAIC-GM-Wuling (SGMW) joint venture secured the fifth position with 170.000 sales. Known for its affordable, compact EVs like the Wuling Hongguang Mini EV, SGMW has found success by targeting budget-conscious consumers, especially in urban areas.

Hyundai-Kia, however, saw a dip in its market position. With 115.000 units sold in Q3, the group has struggled to keep pace with competitors, partly due to a lack of major new releases during the period. In contrast, BMW has continued its upward trajectory, selling 104.000 vehicles. The German luxury brand’s iX and i4 models have resonated with buyers looking for premium electric options, solidifying BMW’s place in the EV space.

China dominates the top 10

Chinese automakers solidified their dominance, with five brands in the global top 10. Beyond BYD and Geely, GAC and its AION brand sold 102.000 units, while Changan delivered 73.000. These figures highlight the strength of China’s EV sector, which benefits from government support, an expanding consumer base, and aggressive innovation.

Legacy automakers and emerging brands

While the top players thrived, other brands struggled to make a significant impact. Stellantis and General Motors tied with 65.000 EVs each, showing steady but unspectacular progress. Meanwhile, companies like Mercedes-Benz (61.000), Nio (62.000), and Leapmotor (60.000) showcased the diversity of players in the market.

Smaller, emerging players like XPeng (47.000) and VinFast (22.000) are gaining ground, though they still face steep competition. Legacy automakers, such as Toyota (35.000) and Ford (32.000), continue to trail behind as they work to scale their EV production. Honda, Renault, and Nissan each recorded modest sales, hovering around 20.000 units, reflecting the challenges traditional automakers face in keeping up with dedicated EV companies.

Looking ahead

The Q3 2024 results tell a story of rapid change and intense competition. Tesla and BYD are firmly at the forefront, but the rise of Chinese automakers like Geely and GAC signals a broader shift in global market dynamics. Legacy brands, while still present, are racing to innovate and expand their EV offerings to remain relevant.

As the market evolves, the coming quarters will be critical. New model launches, advances in battery technology, and geopolitical factors will all play a role in shaping the future of the EV industry. One thing is clear: the race to dominate the electric vehicle market is far from over.

Source: Car Industry Analysis