Moving toward zero-emission commercial vehicles

The shift towards zero-emission vehicles is gaining momentum, with truck manufacturers around the globe pushing forward with big plans to ramp up production of electric and hydrogen fuel-cell trucks. While the speed of adoption varies significantly between countries and different types of vehicles, these truckmakers are finding ways to deal with supply chain challenges and meet ambitious climate goals.

Battery-electric trucks are leading the charge. In the first half of 2024, they made up over 90% of all zero-emission medium- and heavy-duty truck sales. This shift is largely thanks to the maturity of battery technology and a steady drop in costs. By comparison, fuel-cell trucks, which rely on hydrogen, are seeing slower adoption outside of China. In China, generous subsidies and available infrastructure have made them a more viable option.

The role of supply chain partnerships

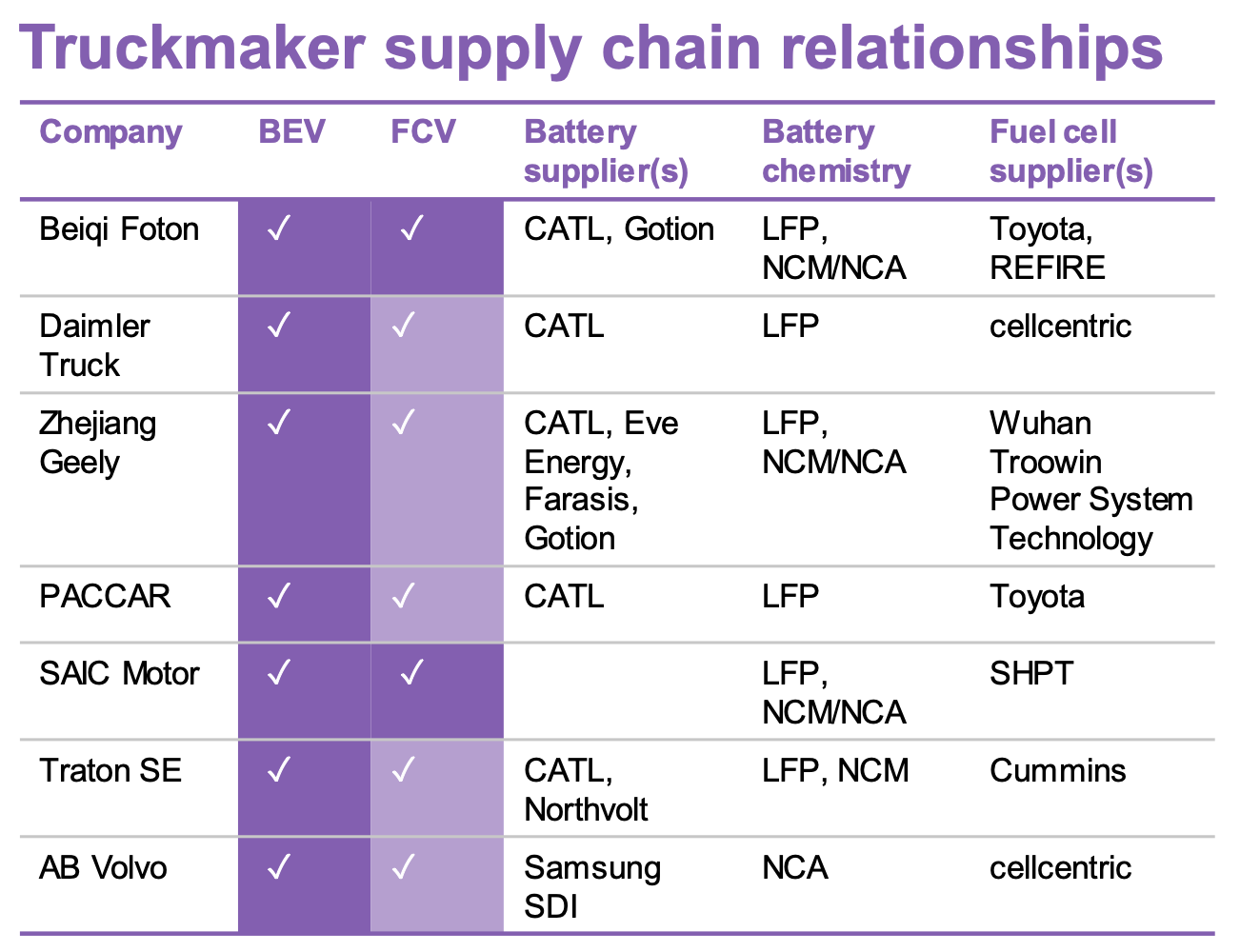

Truck manufacturers are reshaping their supply chains by partnering with specialised companies. This helps them secure key components and prepare for the growing demand for zero-emission technology. The BNEF report outlines several key collaborations, involving traditional truckmakers, battery suppliers, and emerging players in hydrogen fuel-cell technology.

Most European and North American manufacturers are still buying battery cells from outside suppliers while assembling the battery packs themselves. For instance, companies like Volvo and Daimler have teamed up with suppliers like CATL to secure lithium-iron phosphate (LFP) batteries, which are known for being both affordable and long-lasting. Paccar and Traton, Volkswagen’s commercial vehicle arm, are also following a similar approach. Traton has even invested in Northvolt, a battery manufacturer, to ensure more control over supply.

To cut down on dependency, several truckmakers plan to start producing their own battery cells by the end of the decade. For Chinese truckmakers, the situation is different. They’ve already benefited from China’s advanced battery supply chain, adopting LFP batteries early to make their electric trucks more affordable.

Hydrogen fuel-cell technology, on the other hand, is still in its early stages, particularly compared to electric battery technology. Progress in this area is mostly happening through joint ventures. Daimler and Volvo, for example, formed a partnership called Cellcentric, which aims to develop fuel-cell systems specifically for heavy-duty trucks.

Regional differences in adoption

Adoption of zero-emission trucks is uneven across the globe. China is leading the way in both battery and fuel-cell truck sales. Domestic companies like SANY and XCMG dominate the market, supported by the country’s advanced battery supply chain and the use of LFP chemistry, which helps keep vehicles affordable.

In Europe, truckmakers such as Volvo and Daimler are setting the pace, aided by strict emissions regulations and government incentives. Volvo, for example, holds a much larger share of the European electric truck market than it does overall, showing its focus on zero-emission technology.

The United States, however, is struggling to keep up. Only around 1.000 zero-emission trucks were sold in the U.S. during the first half of 2024. The market there is limited by a shortage of models, supply issues, and high upfront costs. But companies like Nikola are trying to break through by delivering hydrogen trucks with temporary refueling options to ease infrastructure challenges.

Dealing with supply chain challenges

Transitioning to zero-emission vehicles comes with plenty of hurdles. The biggest issues include high upfront costs and uncertainties around the future value of used batteries. To overcome these, truckmakers are getting creative.

The high cost of electric trucks continues to be a major obstacle. However, the report notes that new financing models are emerging. Leasing platforms and group purchasing for smaller operators are helping make electric trucks more affordable. In addition, fleet owners are working closely with energy providers to set up dedicated refueling stations, which helps stabilise costs and ensure reliable energy supplies.

Truckmakers are also looking at ways to extend the life of their vehicle batteries through recycling and second-life applications. This helps manage costs and aligns with stricter environmental regulations, which are pushing for a reduction in the carbon footprint of battery production. Increasingly, truck batteries are being reused in stationary energy storage, giving them a second life after they’re done powering vehicles.

Opportunities for truckmakers and investors

Adoption of zero-emission commercial vehicles is still in the early stages, but the potential for growth is enormous. Many manufacturers have set ambitious targets for the next decade. Volvo, for example, aims for most of its sales to be zero-emission by 2030, while Daimler plans for all its truck sales in Europe, North America, and Japan to be carbon-neutral by then.

The partnerships between truckmakers, battery suppliers, and energy companies are crucial for scaling up this market. These collaborations are not only helping solve the current challenges but also laying the groundwork for a sustainable, large-scale zero-emission vehicle infrastructure.

For investors, this transition offers significant opportunities. New financing models and innovative business partnerships could unlock the potential for fleet electrification on a massive scale. This shift is expected to bring strong financial returns while also contributing to meaningful climate action. As technologies mature and initial barriers are overcome, the work being done today will help shape the future of road transport across the globe.

Source: BloombergNEF