Ultra-rapid charging network +83% yoy growth

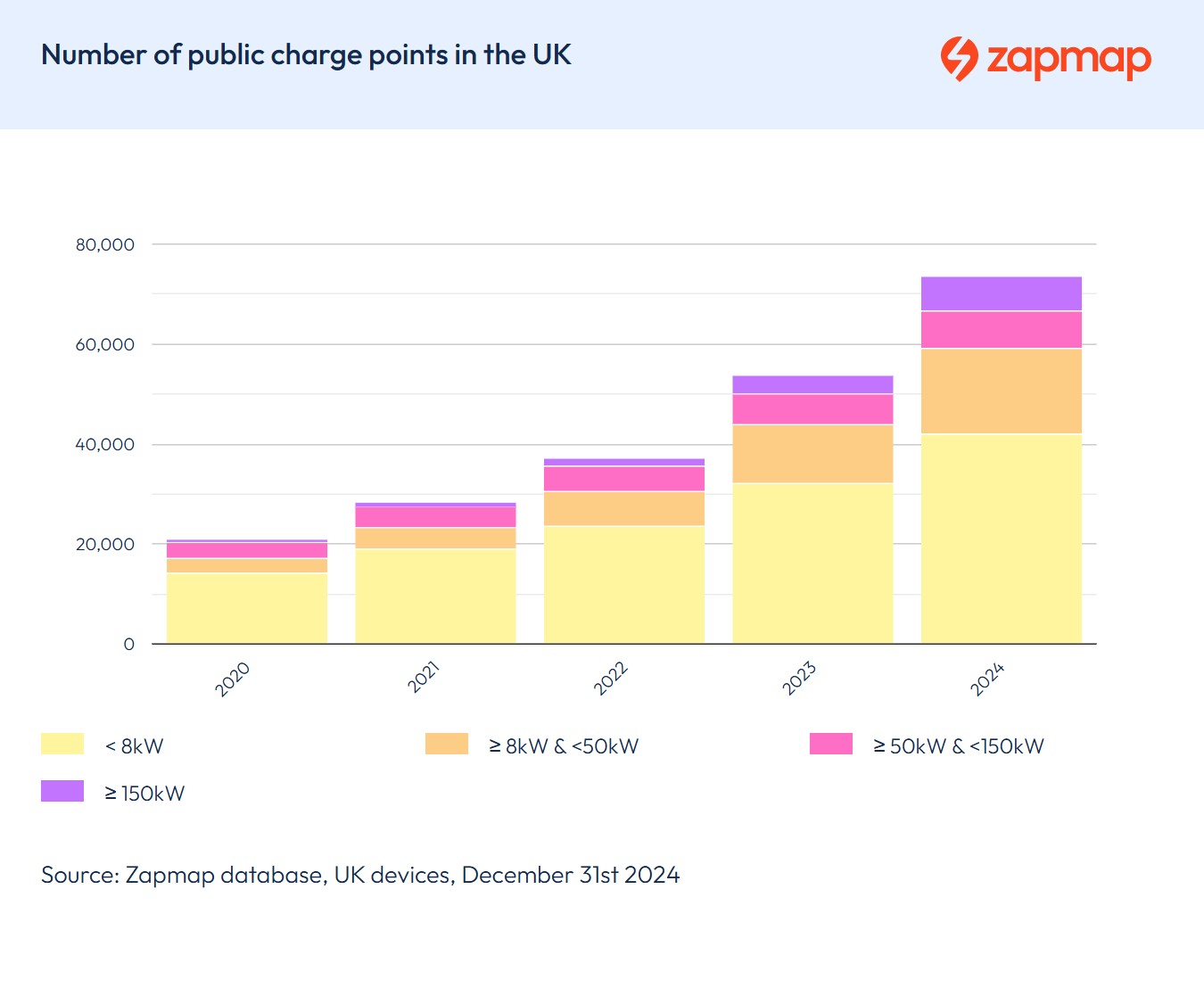

The most significant growth in 2024 was observed in ultra-rapid (150kW+) chargers. These chargers, designed for quick refueling on longer journeys, saw an 83% increase, with 3,196 new devices installed. By the end of the year, there were 7,021 ultra-rapid chargers in operation. These devices are not limited to motorway service areas but have also been deployed at retail parks, car parks, and even farm shops, offering drivers greater convenience and flexibility.

The rapid charging segment (50-149kW) also expanded, growing by 19% to 7,450 devices. Meanwhile, slow and fast chargers (under 50kW) accounted for the largest share of installations, increasing by 36% to 59,228 devices. This broad-based growth underscores the UK’s commitment to meeting diverse charging needs, from urban on-street chargers to high-speed en-route solutions.

Charging hubs, which feature six or more rapid or ultra-rapid devices, more than doubled in number—rising from 264 in 2023 to 537 in 2024, a staggering 103% increase. These hubs are proving particularly popular among EV drivers, addressing concerns about charger availability and queue times at high-demand locations.

On track, 1.650 installations per day

The UK’s efforts are aligned with its ambitious goal of reaching 300,000 public charge points by 2030. The National Audit Office recently confirmed that the country remains on track to achieve this milestone. The monthly installation rate climbed from an average of 1,400 in 2023 to 1,650 in 2024, reflecting an accelerating pace of development. However, sustaining this momentum will require continued investment and policy support.

Regional Disparities and On-Street Charging

Despite these impressive numbers, regional disparities persist. Greater London accounts for 72% of the UK’s on-street chargers, leaving many areas under-served. While cities like Coventry and Liverpool have made strides, the overall provision of on-street charging remains uneven. The Local Electric Vehicle Infrastructure (LEVI) fund, expected to yield results in 2025, aims to address this imbalance by enabling local authorities to deploy chargers in underserved areas.

Notably, en-route charging outside London showed marked improvement in 2024. Nine out of 12 regions now have over 1,000 rapid chargers, reflecting a more equitable distribution of high-speed charging infrastructure. However, Wales, the North West, and Northern Ireland continue to lag, highlighting the need for targeted initiatives to close these gaps.

Rising EV Adoption

The surge in charging infrastructure coincides with record-breaking EV sales. In 2024, over 380,000 pure-electric vehicles were sold, accounting for more than 19% of all new car sales. The total number of EVs on UK roads rose to 1.36 million, a 39% increase from 2023. This growth further emphasizes the importance of reliable and accessible public charging options.

Zapmap’s annual survey revealed an 87% satisfaction rate among EV drivers, with fewer than 3% considering a return to petrol or diesel vehicles. While 80% of EV owners primarily charge at home, 51% use public chargers at least once a month. Public infrastructure remains critical for those without off-street parking and for long-distance travellers.

UK’s Leading Public Charge Point Operators by Network

A key highlight of the UK’s public charging ecosystem in 2024 is the dominance of specific networks. Shell Recharge ubitricity leads the pack, thanks to its extensive network of lamppost chargers. Following closely is Connected Kerb, known for its widespread on-street charging infrastructure. In third place is Pod Point, which specialises in destination chargers, frequently found in retail car parks, mainly supermarkets.

This data encompasses devices across various power ratings, showing networks with the most charge points but not necessarily the highest charging capacity. With Shell Recharge ubitricity’s focus on lamppost chargers, its contribution to urban EV accessibility is particularly notable.

Challenges in Reliability and Accessibility

Reliability and availability remain key concerns for EV drivers. Although 61% of respondents noted improvements in public charging infrastructure over the past year, issues such as broken chargers and queuing times persist. The Public Charge Point Regulations (PCPR), introduced in November 2024, aim to address these challenges by mandating 99% reliability for rapid chargers, contactless payment options, and 24/7 helplines.

Outlook UK’s Charging Network Deployment towards 2025

2025 promises to build on 2024’s successes. The LEVI fund’s rollout is expected to boost on-street charging availability, particularly in underserved areas. Additionally, advancements in charging technology, such as ISO 15118-compatible charge points, will enable seamless “Plug & Charge” functionality, enhancing user convenience.

Flexible energy tariffs already piloted by UK energy providers represent another significant opportunity. These tariffs encourage EV owners to charge during off-peak hours, reducing costs and supporting integrating renewable energy into the grid. Such innovations will not only benefit drivers but also help balance electricity demand.

Moreover, the government’s Zero Emission Vehicle (ZEV) mandate, set to take effect in 2025, will compel automakers to accelerate EV production, reinforcing the transition to a zero-emission future. However, the expiration of grants for residential and workplace charge points in March 2025 raises concerns about the accessibility of home charging options. Policymakers must consider extending these incentives or introducing alternatives to maintain momentum.

A Bright Future for Electric Mobility

The UK’s public charging ecosystem is evolving at an unprecedented pace, setting the stage for a sustainable, all-electric future. While challenges remain, the progress made in 2024—from record-breaking infrastructure growth to improved regional equity—is cause for optimism. With continued investment, technological advancements, and supportive policies, the UK is continuing to lead electrification in Europe.

Credits: This article was developed using the expertise and data insights provided by Zapmap and Schmidt Automotive Research.