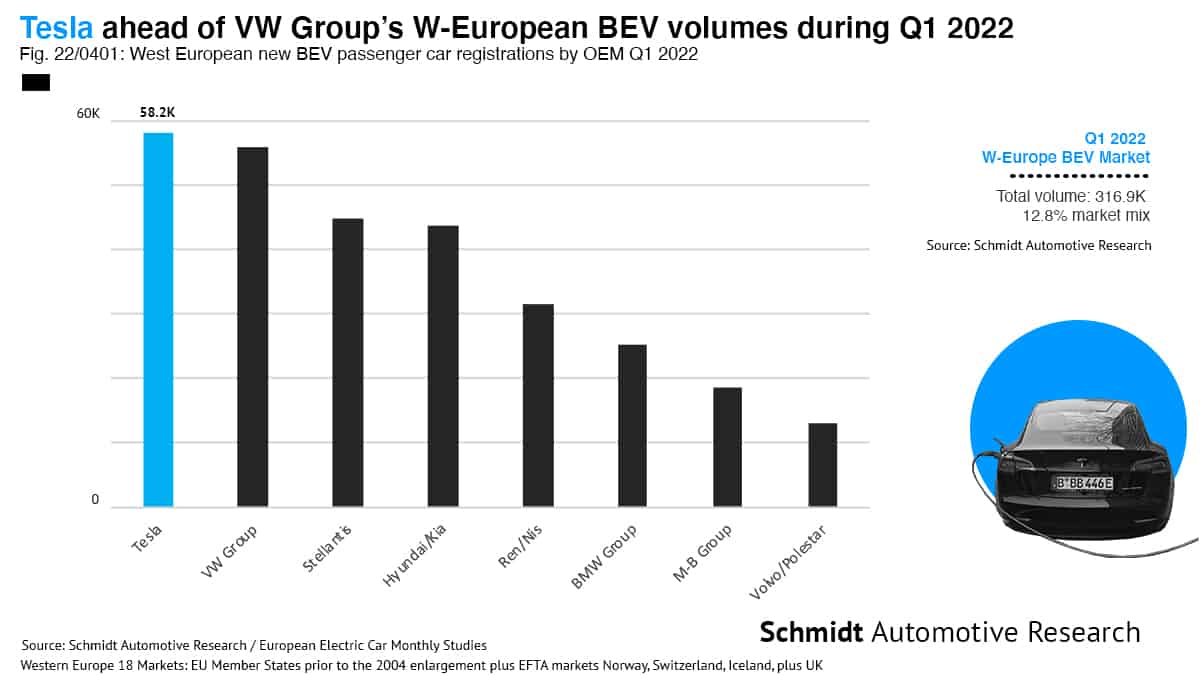

Thanks to EU/UK and Swiss CO2 fleet average compliance targets, OEMs are still giving their BEV models preferential treatment when it comes to the limited amount of semi-conductors to go around. It now appears this situation is unlikely to change for the remainder of 2022 and will likely drag into 2023 according to consensus across the industry. Twenty-two per cent of all the new passenger cars that entered West European roads during the first quarter of 2022 were plug-in, with BEV accounting for 12.8 per cent and PHEVs 9.2 per cent. The BEV 12-month rolling total continued to rise to above 1.3 million units while PHEVs have begun heading in the other direction, having recently broken through the 12-month annualised 1 million barrier.