Growth fuelled by rising EV adoption

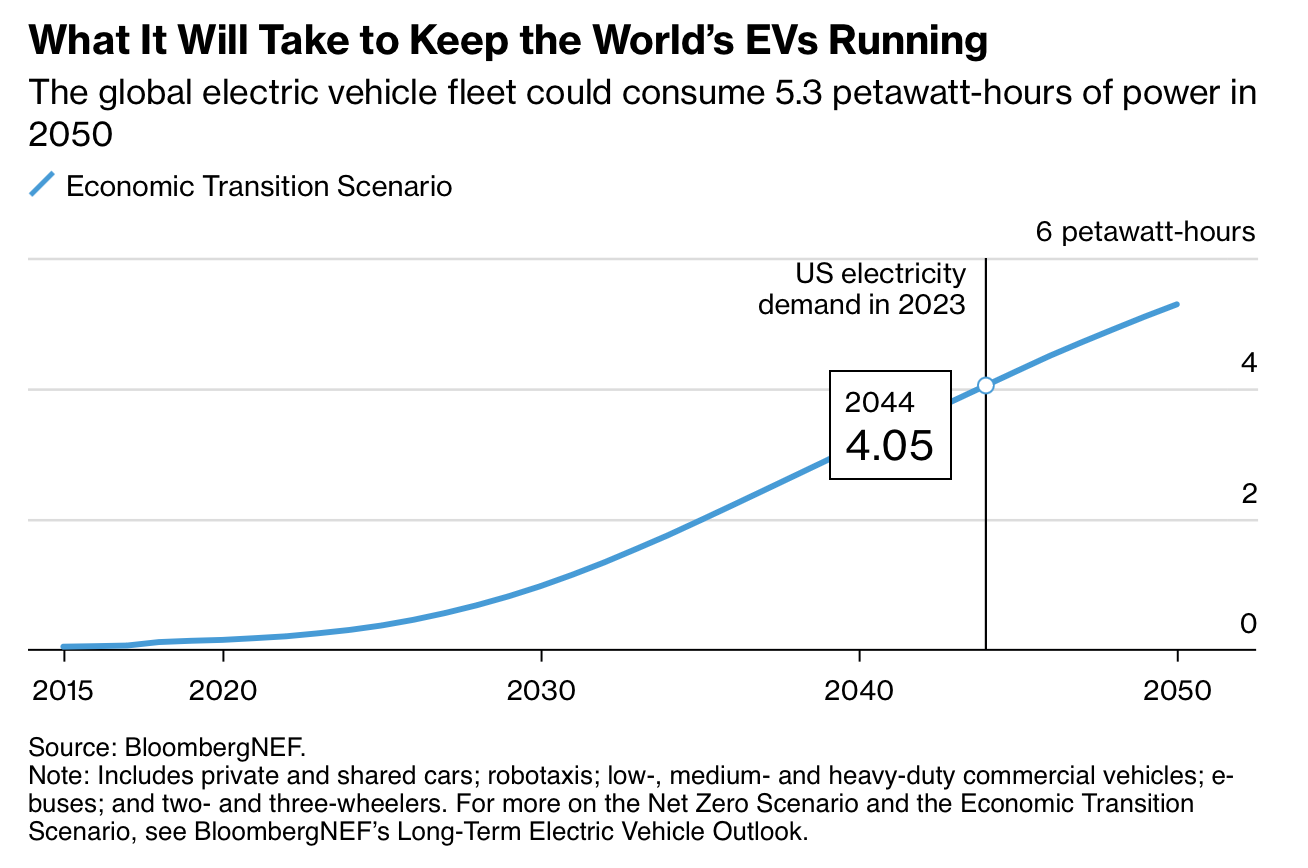

One thing’s for sure—EVs are here to stay, and that’s driving the need for more charging stations. BNEF predicts that by 2044, the electricity needed to power all these chargers will increase by a staggering 30 times. Public charging stations, in particular, will be in high demand, with over 40% of that electricity being used by these networks.

But it’s not just about plugging in and powering up. The road ahead has its bumps. Recently, the growth in EV sales has started to slow, and some car manufacturers are pulling back on their investments. This could have a ripple effect on the charging market. Plus, with ongoing trade tensions between Europe and China and the possibility of political shifts in the U.S., the future is far from certain.

The need for investment amid growing competition

To meet the expected demand, BNEF estimates that around $774 billion will need to be poured into public charging networks by the middle of the century. That’s a huge amount of money, especially when you consider that investors are becoming more cautious. With competition heating up and profits not yet materialising, only the strongest companies will survive. Those without deep pockets could struggle to keep going during tough times, while the bigger players snap up the best locations.

Right now, a lot of the investment is focused on fast charging stations, which are being installed faster than EVs are being sold in some places. This is good news for drivers, as it means more places to quickly charge their cars—sometimes to 80% in just 20 minutes. In countries like France, the number of ultra-fast chargers has improved significantly. For example, there’s now one ultra-fast charger for every 77 electric vehicles, compared to one per 290 vehicles just a couple of years ago.

However, just because there are more chargers, doesn’t mean the companies running them are making money. In Europe, where competition is particularly fierce, some operators are already feeling the pinch. Allego, a European charging network operator, recently decided to delist from the New York Stock Exchange after seeing its share price tumble since going public. According to BNEF, no public charging companies are turning a profit yet, though some, like Fastned, have managed to become EBITDA positive.

Regional differences in infrastructure development

The future of the EV charging market isn’t going to look the same everywhere. In China, which is leading the way in EV adoption, the number of new fast chargers might actually need to drop a bit in the coming years. On the other hand, the U.S. has a lot of catching up to do, needing to triple its current rate of installations just to keep pace. That’s where federal programs like the $7.5 billion National Electric Vehicle Infrastructure (NEVI) Program come into play—they’re crucial for building out the charging network across the country.

Europe also faces its own set of challenges. While the region has made strides in increasing the number of chargers, the competition is fierce, and companies are vying for a bigger slice of the pie. The density of electric vehicles to ultra-fast chargers has improved, but the market is still evolving rapidly.

Technological and market shifts on the horizon

Looking ahead, technology could change the game for EV charging. As more vehicles become capable of charging at 350 kilowatts, fewer chargers might be needed overall because they’ll be able to power up cars faster. And with innovations like wireless charging and autonomous vehicles on the horizon, some of the infrastructure being built today might not be around for long.

In the end, the global EV charging market is heading for significant growth, but it’s also at a critical turning point. Companies in this space will need to be smart about how they navigate the challenges ahead. It’s a tricky balance—investing in infrastructure that might not pay off right away while staying ahead of the competition. For some, the journey will be tough, but for those that can weather the storm, there’s a big opportunity on the horizon.

Source: Bloomberg